InterBank offers business checking and savings accounts, plus, cash management programs for every size of business. Business accounts are available for corporations, unincorporated associations, limited liability companies, partnerships, sole proprietorships, and fiduciaries.

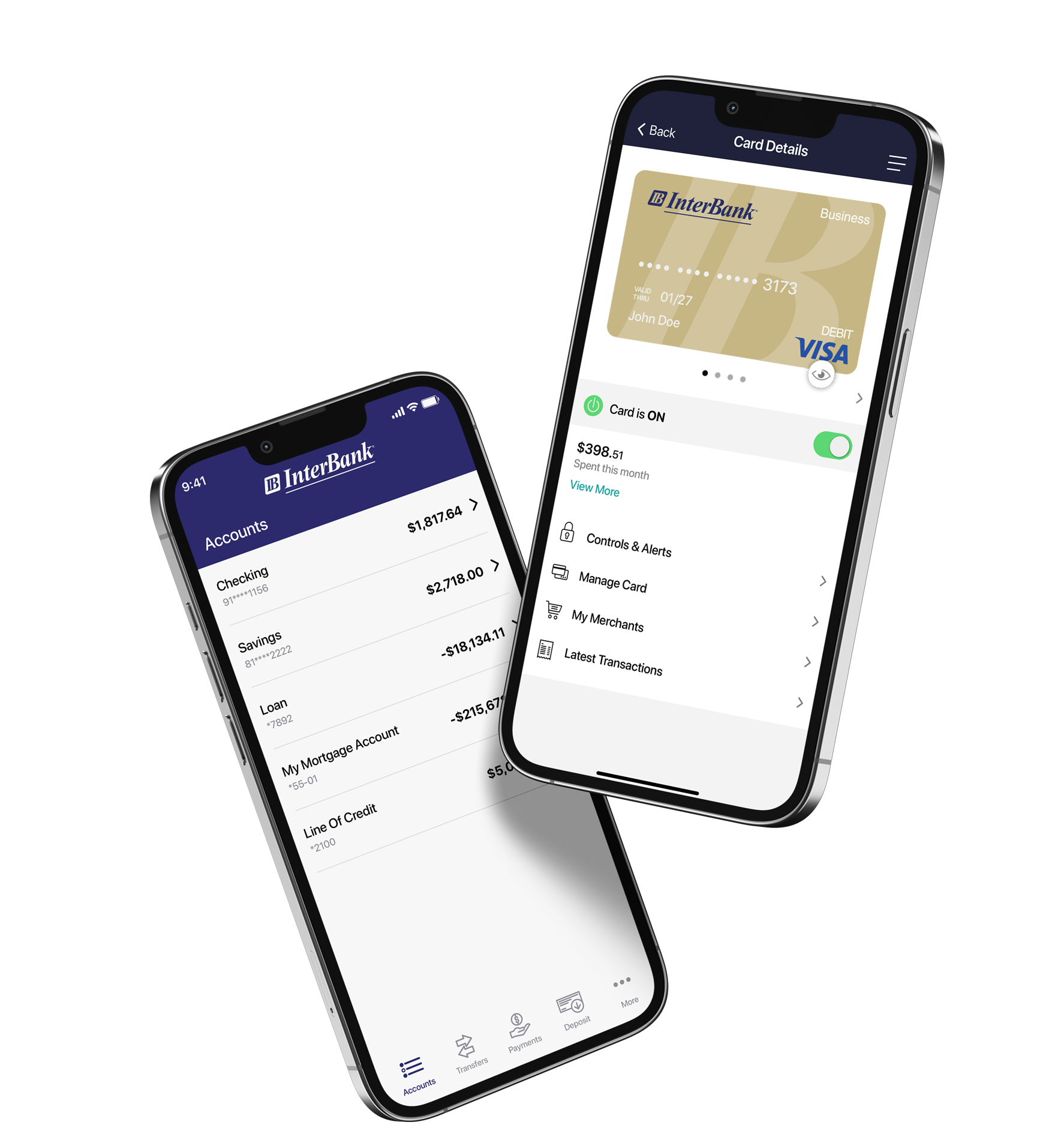

Everyday business solutions with flexibility, convenience, and security

- Personalized business Visa Debit Card

- Business Online Banking

- Business eStatements

- Regular and interest-bearing business accounts

- Convenient business mobile app

- Debit card control with business Card Manager

- Business Fraud Text Alerts

Feature-packed Business Cardholder Benefits

Visa Benefits

Learn more about the unique benefits and solutions available for your business.

Card Manager

Manage your card usage through your mobile device by defining when, where, and how the card is used.

Chip Technology

Improves the global usability and security of your card as more merchants at home and abroad switch to advanced chip card terminals.

Business Account Comparison

| Small Business Checking | Business Checking | Business Checking with Interest | Money Market | High-performance Money Market | Regular Savings | |

|---|---|---|---|---|---|---|

| Minimum Opening Deposit | $100 | $100 | $100 | $100 | $100 | $100 |

| Monthly Service Fee | $8 Waived with average monthly balance of $500 |

$10 | $10 | $10 Waived with average monthly balance of $1,000 |

$18 Waived with average monthly balance of $15,000 |

$3 Waived with average monthly balance of $300 |

| Analysis Fee | Free Per Month 100 Deposited items ($.10 each additional) Free Per Month 25 Debits ($.15 each additional) |

$.10 Service Fee per Deposited Item $.15 Service Fee per Debit $.20 Service Fee per Credit |

$.10 Service Fee per Deposited Item $.15 Service Fee per Debit $.20 Service Fee per Credit |

|||

| Earnings Credit on Analysis Fee | Earnings credit is accrued on the average daily balance to offset monthly maintenance charges and transaction fees. |

|||||

| Complimentary Business Debit Card, Online Banking, Mobile Banking, Telephone Banking, E-Statements & Bill Pay: | ||||||

| Mobile Deposit1 | ||||||

| Paper Statement with Images | ||||||

| Unlimited Transactions: | 2 | 2 | 2 | |||

| Pays Interest |

1Mobile Deposit is available for accounts that have been open at least six (6) months and have not had insufficient return activity within the prior 6 month period. Standard daily limits are set at $2,500.00 per day.

2An excess debit charge over the six (6) allowed debits, a fee of $10 per excess debit will be charged to your account. Transfers and withdrawals made in person, by messenger, by mail or at an ATM are unlimited.

Ready to open a business account?

Discover a local, personalized banking experience backed by competitive products, innovative services, and real relationships.

FDIC-Insured—Backed by the full faith and credit of the U.S. Government

FDIC-Insured—Backed by the full faith and credit of the U.S. Government